Capital Budgeting by Maxusknowledge Team

Published 10/2023

MP4 | Video: h264, 1920x1080 | Audio: AAC, 44.1 KHz

Language: English | Size: 998.36 MB | Duration: 4h 25m

Methods and techniques used in Capital Budgeting

What you'll learn

Understand the concepts of Capital Budgeting and its classification

Learn the fundamentals of Net Present Value alongwith examples

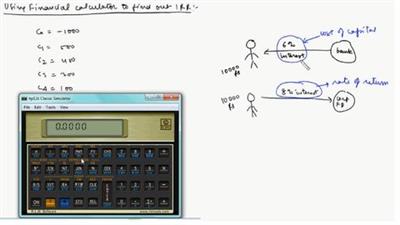

Identify the Modified and Multiple Internal rate of return using examples

Learn the concept of Payback period using even cashflow, uneven cashflow and project comparison

Requirements

You don't need any perquisites for taking this course

Description

Capital budgeting is an important process in business that helps companies make wise financial decisions when investing in long-term projects such as purchasing property, buying new equipment, and launching new products. Discover the fundamentals of capital budgeting and find out how to create a plan that helps grow your business with smart investments.What is Capital Budgeting? Capital budgeting in financial management is the process of analyzing potential investments or expenditures that have long-term impacts on a business's financial health. A project on capital budgeting typically involves forecasting, analyzing, and evaluating future returns from a proposed investment over an extended period of time. When deciding whether to invest in a project, businesses must consider the cost of the investment, any uncertain risks involved, and the expected cash flow generated by the investment.The key to successful capital budgeting is accurately predicting a business's future cash flows on investments. From there, businesses can decide whether an investment has the potential to generate enough financial benefits in the long-term to make it worthwhile. Capital budgeting uses a variety of methods and tools to evaluate potential investments, such as net present value, internal rate of return, and payback analysis. With these, businesses can more accurately determine the economic feasibility of their investments and proactively manage their finances for maximum profitability.There are several common capital budgeting techniques that businesses use to help them make decisions, such as net present value (NPV), internal rate of return (IRR), and discounted cash flow (DCF). These methods provide a more comprehensive way to analyze investment options. By incorporating non-cash items like depreciation and tax into financial models, decision makers can get a clearer picture of the profitability of their investments. By utilizing the capital budgeting system, businesses are better able to assess risk and identify potential opportunities for growth that could lead to the best possible outcome for their company's bottom line.

Overview

Section 1: Concepts of Capital Budgeting, NPV, Payback period, Discounted payback period

Lecture 1 Fundamentals of Capital budgeting

Lecture 2 Fundamentals of Net Present Value (NPV)

Lecture 3 Net Present Value - Example 1

Lecture 4 Net Present Value - Example 2

Lecture 5 Fundamentals of Payback period - Part 1

Lecture 6 Fundamentals of Payback period - Part 2

Lecture 7 Payback period - Example 1 - Even cash flow

Lecture 8 Payback period - Example 2 - Uneven cash flow

Lecture 9 Payback period - Example 3 - Project comparison

Lecture 10 Discounted payback period - Fundamentals

Lecture 11 Discounted payback period - Example 1

Section 2: IRR, MIRR, Profitability Index, Project classification

Lecture 12 Fundamentals of Internal rate of return (IRR) - Part 1

Lecture 13 Fundamentals of Internal rate of return (IRR) - Part 2

Lecture 14 Internal rate of return (IRR) - Example 1

Lecture 15 Multiple Internal rate of return - Example 1

Lecture 16 Fundamentals of Modified Internal rate of return (IRR)

Lecture 17 Modified Internal rate of return (MIRR) - Example 1

Lecture 18 Modified Internal rate of return (MIRR) - Example 2

Lecture 19 Modified Internal rate of return (MIRR) - Example 3

Lecture 20 Fundamentals of Profitability index

Lecture 21 Profitability index - Example 1

Lecture 22 Project classifications - Part 1

Lecture 23 Project classifications - Part 2

Lecture 24 Fundamentals of Accounting rate of return (ARR)

Lecture 25 Summary of Capital budgeting methods

The course can be useful for students studying financial management and professionals working as financial decision-makers.

Screenshots

Download link

rapidgator.net:

https://rapidgator.net/file/83e3d9096b3ff56bc76c0411af5805a6/svgna.Capital.Budgeting.by.Maxusknowledge.Team.part1.rar.html https://rapidgator.net/file/88f72715d13525effecbef4dd05df28a/svgna.Capital.Budgeting.by.Maxusknowledge.Team.part2.rar.html

uploadgig.com:

https://uploadgig.com/file/download/0f9c9D1f71c44725/svgna.Capital.Budgeting.by.Maxusknowledge.Team.part1.rar https://uploadgig.com/file/download/152d4df951f4C1a1/svgna.Capital.Budgeting.by.Maxusknowledge.Team.part2.rar

nitroflare.com:

https://nitroflare.com/view/348B05F0612567C/svgna.Capital.Budgeting.by.Maxusknowledge.Team.part1.rar https://nitroflare.com/view/B281F6792C80832/svgna.Capital.Budgeting.by.Maxusknowledge.Team.part2.rar